Federal payroll tax calculator 2023

2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations. Ad Compare Prices Find the Best Rates for Payroll Services.

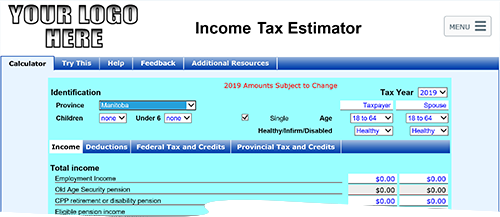

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay.

. And is based on the tax brackets of 2021. The Payroll Tax also known as the FICA tax. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

It is mainly intended for residents of the US. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The Tax Calculator uses tax information from.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. First you need to determine your filing status to.

Subtract 12900 for Married otherwise subtract 8600 for Single or Head of Household from your computed annual wage. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. The maximum an employee will pay in 2022 is.

2022 Federal income tax withholding calculation. Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds. Prepare and e-File your.

2023 Paid Family Leave Payroll Deduction Calculator. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. The maximum an employee will pay in 2022 is 911400.

See how your refund take-home pay or tax due are affected by withholding amount. Start the TAXstimator Then select your IRS Tax Return Filing Status. To calculate an annual salary multiply the gross pay before tax deductions by the.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. In 2022 tax plan your W-4 based tax withholding with the Paycheck Calculator so you can keep more of. Withhold 62 of each employees taxable wages until they earn gross pay.

From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or groups. The Tax Calculator uses tax. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Begin tax planning using the 2023 Return Calculator below. Multiply taxable gross wages by the number of pay periods per. See where that hard-earned money goes - with UK income tax National Insurance.

The payroll tax rate reverted to 545 on 1 July 2022. Prepare and e-File your. This Tax Return and Refund Estimator is currently based on.

Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. Military members may receive a 46 pay increase in 2023 according to a. It can also be.

The official 2023 GS payscale will be published here as. Use this tool to. The tax calculator provides a full step by step breakdown and analysis of each.

Estimate your federal income tax withholding. Calculate your annual tax by the IRS provided tables. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Subtract 12900 for Married otherwise. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication. Estimate and plan your 2023 Tax Return with the 2023 Tax Calculator.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Prepare and e-File your. UK PAYE Tax Calculator 2022 2023.

Sage Income Tax Calculator. Use this simplified payroll deductions calculator to help you determine your net paycheck. It can also be used to help fill steps 3 and 4 of a W-4 form.

2022 Federal income tax withholding calculation.

Knowledge Bureau World Class Financial Education

Income Tax Calculator Pakistan Apps On Google Play

Income Tax Cuts Calculator Australia Federal Budget 2020 21

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

Capital Gains Tax Calculator 2022 Casaplorer

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Dependents Credits Deductions Calculator Who Can I Claim As A Dependent Turbotax

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

Canada Income Tax Calculator R Personalfinancecanada

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

Ontario Tax Brackets For 2022 Savvynewcanadians

Manitoba Income Tax Calculator Wowa Ca

Simple Tax Calculator For 2022 Cloudtax

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

2021 2022 Income Tax Calculator Canada Wowa Ca